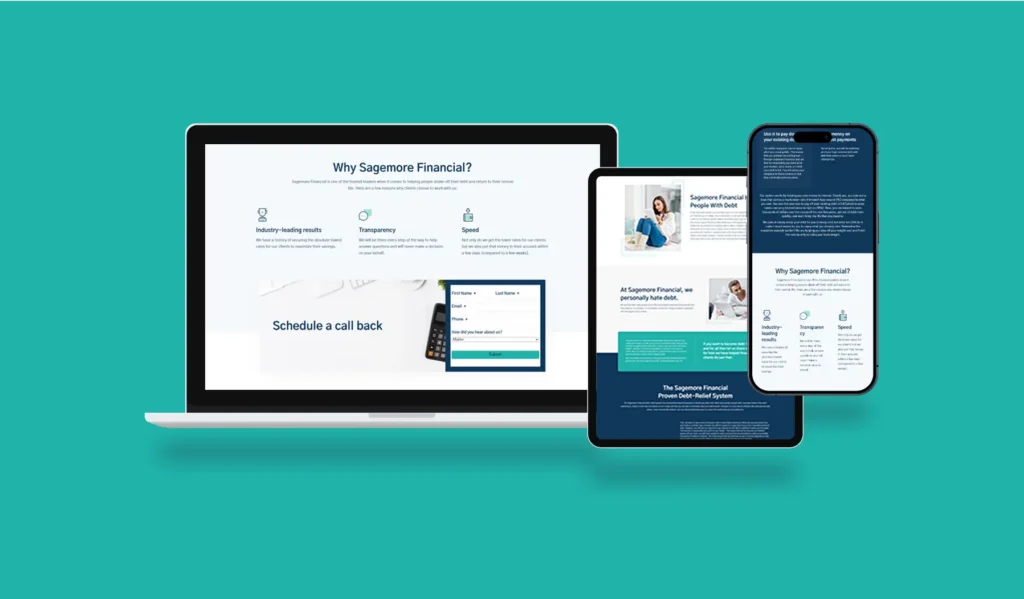

Sagemore Financial specializes in helping individuals consolidate high-interest debt into manageable payments, offering personalized financial solutions to reduce stress and improve financial well-being.

Despite offering valuable debt consolidation services, Sagemore Financial faced challenges in competing with larger financial institutions and building trust with potential clients. To address this, the company implemented a content-driven approach, targeted advertising, and an automated follow-up system to engage and convert leads. Additionally, customer reviews and testimonials played a key role in establishing credibility. These efforts led to a significant increase in consultation requests, higher-quality leads, and improved client retention.

In a competitive financial services industry, Sagemore Financial needed to stand out against well-established institutions. The primary challenges included building trust, generating quality leads, and converting inquiries into long-term clients.

To overcome these obstacles, Sagemore Financial implemented a strategic approach:

These strategies resulted in remarkable business growth and improved client engagement:

By leveraging educational content, targeted digital marketing, and automated follow-ups, Sagemore Financial successfully increased its brand credibility, generated more high-quality leads, and improved client retention. With a strong foundation in trust-building and customer engagement, the company continues to empower individuals on their journey to financial freedom.

Trustindex verifies that the original source of the review is Google. I recently worked with Lead Origin to help boost my company's online presence and I couldn't be happier with the results. From the initial consultation to the final project delivery, the team at Lead Origin was professional, knowledgeable, and easy to work with. They took the time to understand my business and target audience, and created a customized marketing strategy that helped us reach our goals. Their expertise in digital marketing and social media management was evident throughout the entire process, and I was consistently impressed with their creative ideas and attention to detail. Not only did Lead Origin help increase our online visibility and engagement, but they also provided valuable insights and analytics to track our progress and adjust our strategy as needed. I highly recommend Lead Origin to any businesses looking to take their marketing efforts to the next level. Thank you for your exceptional work!Trustindex verifies that the original source of the review is Google. Hands down the best Company to use for your business. The give a personal touch and keep you ahead of the game.Trustindex verifies that the original source of the review is Google. Lead Origin has been instrumental in enhancing our leads in the PPE industry. Their deep understanding and adaptability have driven impressive results Q1 of 2024. From the get-go, Lead Origin impressed us with their tailored strategies that resonated with our audience. I was afraid they would be another mediocre marketing company with false promises... I stand corrected. My personal opinion of what sets Lead Origin apart is their ability to adapt quickly. Zohaib and Bilal were very responsive when it came to starting new campaigns or creating content. Turnaround time was always less than 24 hours. In summary, Lead Origin is not just a marketing agency; they're strategic partners who drive success. I highly recommend them to any company in the PPE industry looking for exceptional marketing support.Trustindex verifies that the original source of the review is Google. LeadOrigin, LeadOrigin, LeadOrigin. Just saying their name feels like starting a magical story that took my life and business to amazing places. Picture us sitting together, you cozy with a warm drink, and me, ready to tell you a tale that’s a bit like a fairy tale, but real. Hearing "LeadOrigin" might make you think of stars, space, and grand adventures among the galaxies. And that’s not too far from the truth, because they really did take my business on a journey to the stars. My adventure started in the bustling city of Houston, right after I graduated from Rice University. I had big dreams and a big loan, but soon learned that wasn’t enough to succeed. When I was almost out of hope, LeadOrigin came along like a team of space guides. They brought magic to my business with their wisdom and introduced me to helpers from around the world, right at my fingertips, ready to work wonders anytime. Suddenly, life became easy, like I was gliding through it in a spaceship, without a care, much like one of those futuristic cars Elon Musk dreams up. Now, I sit back in my comfortable chair, a glass of sparkling water in hand, looking back at those tough times. I feel a deep sense of gratitude for LeadOrigin. LeadOrigin, LeadOrigin, LeadOrigin. A name I’ll never forget. They didn’t just save my business; they transformed my life into a dream, making it possible for me to cruise through my days while talented people from across the globe help me out, all at the push of a button. They turned my struggles into a journey I’m grateful for, showing me that with the right team, we can indeed reach the stars and make our wildest dreams come true.Trustindex verifies that the original source of the review is Google. Thank you so much to LeadOrigin for all the help with my client. We were dealing with a complex issue and they helped us solve the problem immediately. They treat you like family and work closely in order to make sure the client is 100% satisfied. If you are reading this review and wondering if you should hire this company I recommend you pull the trigger. Thanks LeadOrigin!!!Trustindex verifies that the original source of the review is Google. With Real Estate Twitter/X blowing up, I teamed up with Lead Origin to boost my digital presence and build a personal brand. In just six months I have received a quicker ROI than when I was attempting to do it on my own. I’ve got an extensive amount of deals from hiring them to build my personal brand and I cannot recommend them enough. Everyone needs to hire them!Trustindex verifies that the original source of the review is Google. Thanks to Lead Origin I will never have to find another marketing company ever again they really are a 10 out of 10. If there’s anyone, I would trust, it’s Lead Origin.Trustindex verifies that the original source of the review is Google. I've come to realize that opting for the cheapest option often ends up costing you more down the line. But with LeadOrigin, I've seen for myself that the value you get far outweighs what you put in. Their services have brought me exceptional results, making every penny spent worth it.

Palo Alto

Austin

Houston

Manila

Cebu City

Palo Alto

Austin

Houston

Manila

Cebu City